In collaboration with EMM Research, TBG presents an insightful guide offering a comprehensive view of the current employment landscape. With EMM Research’s expertise in economic research, data services, and consulting, our guide navigates the complexities of today’s competitive labor market, providing valuable insights into national salary standards and industry trends.

2024 Salary Guide

Numbers That Matter

Data Collaboration

- Our guide combines TBG’s proprietary data and insights with information sourced from trusted third-party providers such as EMM Research and

The U.S. Bureau of Labor Statistics.

Organized Insights

- Salary data is meticulously organized by department, job title, and level, offering a clear understanding of compensation structures across various functions.

Flexible Salary Ranges

- Recognizing the diverse factors influencing salaries, we present three ranges—low, mid, and high. This flexibility accounts for variables like experience, expertise, market demand, and company size.

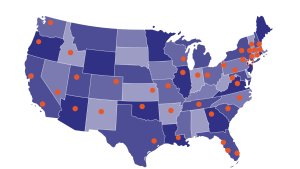

Local Market Comparison

- To contextualize national averages, our guide includes a “regional variance” section at start of this guide. This feature allows readers to assess how wages in their local markets compare to the presented data.

Financial Services Compensation Outlook

Exclusive analysis and insights brought to you by Jordan Shapiro, Senior Managing Director of the TBG Financial Services Division.

2023 bonuses will be flat at best and up to 20% down YoY vs 2022 as financial services firms continue to navigate through a dynamic environment.

Interest rate pressures, volatile public securities markets, decreased M&A activity, and challenging exit opportunities for private capital all contribute to depressed incentive compensation. Public firms struggle with cost reduction while private firms are faced with fee compression, increased competition, and a difficult fundraising environment.

2024 will see an increased proportion of all forms of deferred compensation, including both cash and non-cash elements.

Both buy- and sell-side firms will utilize deferred compensation to better manage short-term cash flow, hedge against departures and, in some instances, encourage employee tenure. Deferred cash remains the favored method, but we are also seeing an increasing amount of awarded but unvested stock, fund carry, and other forms of equity.

While most investment and front office roles will see compensation at par or declining YoY, there remain several functions in such high demand that we expect to see both bonus and total compensation increase.

Accounting, operations, compliance, and certain areas of risk management all see candidate demand outstripping supply. Extremely active hiring markets in these areas over the past two years have driven compensation north of prior years with accounting and fund/trading operations both expected to increase 10-20% depending on firm, level, and function.

We do not anticipate broad staff reductions in 2024, rather selective RIFs in non-revenue generating functions where investments in technology can control employee numbers.

Regardless of 2023’s cautionary tale of balance sheet management, many banks will choose to reduce the number of staff focused on ALM, stress testing, liquidity, and market risk, groups that have seen significant growth since 2020. Use of data solutions, consultants, and improved organizational structure will all drive these changes. We feel banking functions (M&A, trading, etc.) to be appropriately staffed having gone through several prior years of rightsizing.

Several areas of investment management will continue to see increased demand.

Private debt in particular, including originations, underwriting, and operations functions, remains growing in assets and staff level. We expect most other strategies – traditional private equity, hedge funds, and venture capital – to hire at lower volume resulting from capital outflow and market headwinds that impact exit opportunities.

We expect bonus compensation to be tied more directly to individual employee performance than ever before.

Unemployment remains historically low (near practical full employment in the financial sector) and competition to hire exceptional talent will remain intense throughout 2024. Many employers are signaling their desire to break from normalizing bonuses to reward top performers as a key component of staff retention. Low to average performers will see sharper declines in YoY bonus to increase the compensation pool for top performers.

Private fund compensation is more volatile than ever.

Wide swings in annual performance, capital outflows, and heavy competition from other market participants are driving significant disparity in hedge and private equity fund pay. Firms with strong performance will reward top performers more heavily. Weaker performers may find partners allocating disproportional bonus capital to employees to prevent attrition.

Bulge bracket bank compensation will see the largest average decreases of YoY bonuses.

Investment banking, sales and trading, financing, and capital markets all saw challenging and unpredictable years. While trading and some capital markets functions performed well, most investment banking groups generated significantly less revenue in 2023 than 2022. Steady revenue combined with pressure to reduce cost and expense will directly impact employee spend – a bank’s largest cost center.