Job description

Summary

Support the general ledger accounting responsibilities for the firm including the New York head office as well as the domestic and international branch offices.

Essential Duties and Responsibilities include the following. Other duties may be assigned.

- Monthly bank and general ledger account reconciliations to ensure accurate and timely booking of transactions

- P&L variance analysis

- Assist with quarterly and annual tax analyses and filings

- Assist with schedules and analyses for annual firm and pension audits

- Documentation of accounting policies and procedures

- Preparation of journal entries

- Assist with month end close

- Assist with annual budget preparation

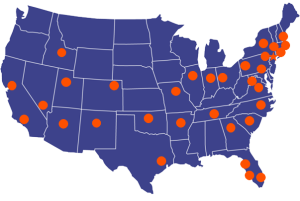

- Branch office support

- Ad Hoc projects

In addition, responsibilities related to maintaining firm and client information are to be adhered to by all employees. This includes complying with the firm’s information security policies, protecting firm assets from unauthorized access, disclosure, modification, destruction or interference, and reporting security events or potential events or other security risks to management.

Qualifications

Excellent MS Excel skills required. Experience with Elite 3E, Sage (Best) Fixed Asset System and Essbase preferred, but not required.

Good problem-solving, organizational, interpersonal and communication skills required. Must exhibit professionalism, flexibility and a teamwork approach. Attention to detail.

Education and/or Experience

B.S. or B.A. Accounting/Finance major required with 1-3 years of general accounting experience. Law firm or public accounting experience preferred.